rhode island tax table

Exemption Allowance 1000 x Number of Exemptions. Apply the taxable income computed in step 5 to the following.

Some Rhode Islanders Still Waiting On Tax Refunds

However if Annual wages are more than 231500 Exemption is 0.

. Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. 2022 Rhode Island Sales Tax Table. Any income over 150550 would be.

Find your pretax deductions including 401K flexible account. This form is for income earned in tax year. Compare your take home after tax and estimate.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated.

EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD. Exemption Allowance 1000 x Number of Exemptions. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children.

Automate manual processes and eliminate human error with Sovos tax wihholding solutions. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. How to Calculate 2022 Rhode Island State Income Tax by Using State Income Tax Table. 2022 Rhode Island Sales Tax Table.

Rhode Island Tax Brackets for Tax Year 2021. Find your income exemptions. A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if.

Rhode Island Income Tax Rate 2022 - 2023. However if Annual wages are more than 221800 Exemption is 0. Ad Accurate withholding repotting to federal state and local agencies for all transactions.

Instead if your taxable income. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

More about the Rhode Island Tax Tables. More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated. 2022 Rhode Island Sales Tax Table.

If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet. We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation.

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. 2020 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

DO NOTuse to figure your Rhode Island tax. Apply the taxable income computed in step 5 to the following. Detailed Rhode Island state income tax rates and brackets are available on.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

Rhode Island Income Tax Calculator Smartasset

State Income Taxes Updated For 2021 Moneytree Software

States With The Highest Lowest Tax Rates

Rhode Island Tax Brackets And Rates 2022 Tax Rate Info

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Division Of Taxation 2019

Will Mississippi Join The No Income Tax Club International Liberty

Massachusetts Rhode Island Natp Chapter 2018

Form Sales Tax Rate Table Fillable 7 Tax Rate

Cost Of Living In Rhode Island Ultimate Guide For 2022

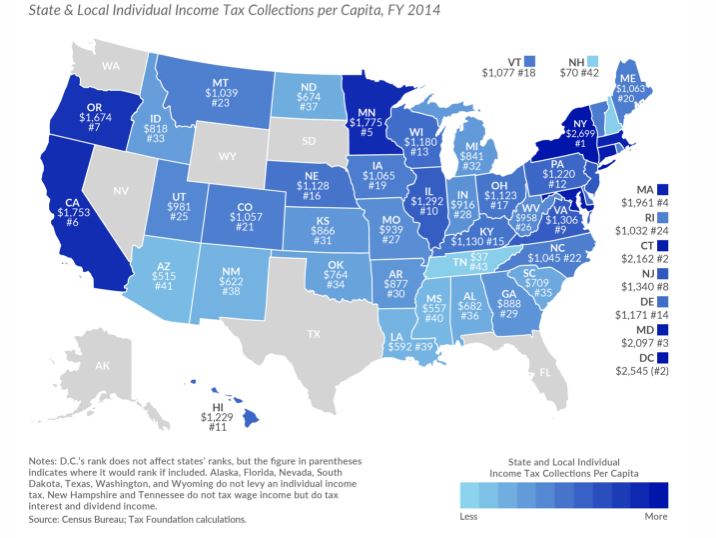

R I State And Local Income Tax Per Capita 2nd Lowest In New England

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Consumer Alert Rhode Islanders Could Owe State Taxes On Unemployment Wjar

Rhode Island Income Tax Rate And Ri Tax Brackets 2022 2023

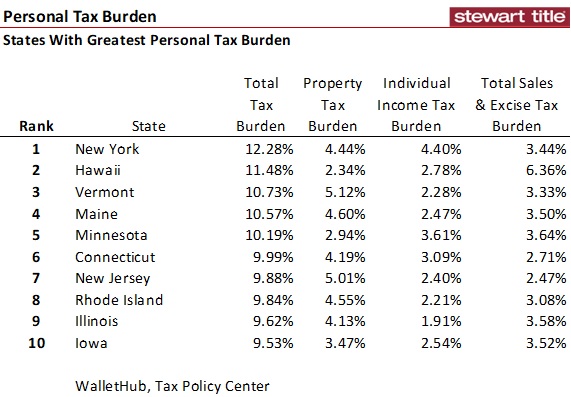

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Basic Information About Which States Have Major Taxes And States Fiscal Years

Rhode Island Income Tax Brackets 2020

Rhode Island Division Of Taxation 2018 Filing Season Presentation Ppt Download