is idaho tax friendly to retirees

But income tax is the 4th highest on the list. To determine the best places to retire in Idaho we weighed a number of different factors crucial to retirement.

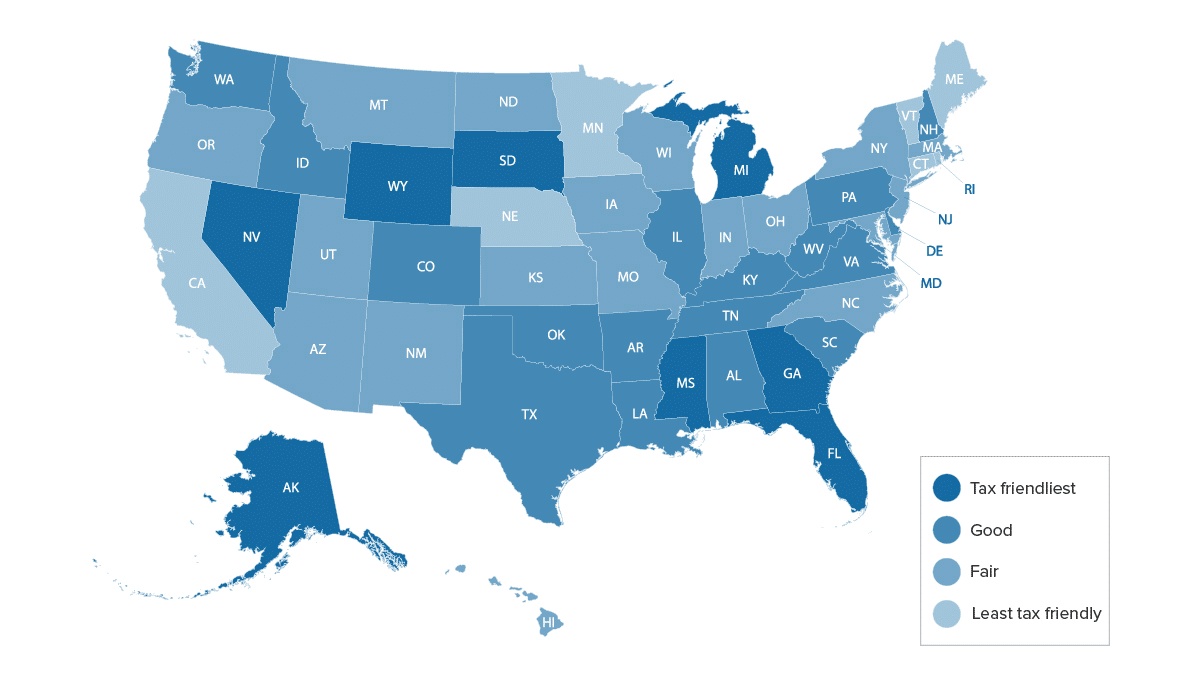

Most Tax Friendly States For Retirees Ranked Goodlife

Idaho ranks middle of the pack in Affordability and Quality of Life.

. 800-352-3671 or 850-488-6800 or. State sales and average local tax. Retirement Living surveyed retirees about how happy they were with their states.

Idaho is tax-friendly toward retirees. For nature lovers and those looking to retire in a place that offers the feeling of being far away from the rat race this may be the place. Gauge your retirement readiness and see where you stand today.

Estate Tax or Inheritance Tax. Employer funded pension plans exempt these self-funded plans may be fully or partly taxable. Learn about how idaho taxes retirement income the food tax credit and the three ways to save money on your property taxes.

Tax burden in retirement for each city comes from 2018. Nebraska is one of the. New Look At Your Financial Strategy.

Find specific information relating to any retirement benefits youre receiving in the Instructions Individual Income Tax. However Texas doesnt make it into our top 10 most tax-friendly states for retirees because of its high sales tax and property tax rates. Retirees benefit from a relatively low property tax and no tax on Social Security income in Idaho.

Retirement income exclusion from 35000 to 65000. In this case the state is coming in at 6 due to it being quite tax friendly for retirees. All the cities listed below have a tax burden of 169.

Part 1 Age Disability and Filing status. Retirement income exclusion from 35000 to 65000. RL Rating 40 percent.

Find specific information relating to. Ad Our 3-Minute Confident Retirement check can help you start finding the answers. Ad Read this guide to learn ways to avoid running out of money in retirement.

404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes. Sales tax in Idaho comes in at a low 6 and prescription drugs as well as income from Social Security are not taxable. If youre a military member temporarily assigned to idaho.

This is why if you are a retiree with a fixed income you might prefer tax-friendly states. Youll get the opportunity to breath and enjoy the raw beauty of nature. Average Combined State and Local Sales Tax Rate.

Whats more Idaho is tax-friendly for retirees. To determine the best places to retire in Idaho we weighed a number of different factors crucial to retirement. Use the instructions for.

The recipient of the retirement benefits must be at least 65 years old OR be classified as disabled and at least 62 years old. Fairly tax-friendly but residents pay full tax on private retirement plans. Take 3 Minutes To Learn How To Boost Your Retirement Savings.

Sales tax in Idaho comes in at a low 6 and prescription drugs as well as income from Social Security are not taxable. 29 on income over 440600 for single filers and married filers of joint returns 4 5. 1614 per 100000 of assessed home value.

To determine the top 25 tax-friendly state for retirees GOBankingRates examined data from the Tax Foundation on each states 1. While potentially taxable on your federal return these arent taxable in Idaho. Income Tax Military pay is tax free if stationed out-of-state.

Idaho Relative tax burden. If you have a 500000 portfolio get this must-read guide by Fisher Investments. California will tax you at 8 as of 2021 on income over 46394.

Median Property Tax Rate. Veterans can minimize how big a bite taxes take by choosing from states that dont tax military retirement. It may be surprising to hear that Idaho known for its agriculture actually has majestic mountains and boasts breathtaking views.

Ad Begin Saving For Your Retirement Today - Your Future Self Will Thank You. Use the instructions for. Exemptions exist for some federal state and local pensions as well as certain Canadian OAS QPP and CPP benefits.

Tax Benefits for Seniors. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Military retirement and SBP recipients can deduct up to 37776 of their retirementSBP income for a single filer or 56664 for a.

323 on all income but Social Security benefits arent taxed.

Is Idaho A Good Place For Retirees 2022

Will You Withhold Idaho Income Tax For Retirees Who Live In Idaho 2022

Where To Retire Cover For 11 1 2019 Magazine Titles Magazine Subscription Autumn Park

State By State Guide To Taxes On Retirees Retirement Strategies Tax Retirement Income

West Virginia Is Third Best State For Retirement Survey Says Wowk 13 News

4 Best Places To Retire In Idaho On A Budget

18 Pros And Cons Of Retiring In Idaho 2020 Aging Greatly

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

Top 5 Places To Retire In Idaho New Cyber Senior

Idaho Retirement Tax Friendliness Smartasset

7 States That Do Not Tax Retirement Income

Idaho Retirement Taxes And Economic Factors To Consider

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

Idaho Retirement Tax Friendliness Smartasset

Map Here Are The Best And Worst U S States For Retirement In 2020

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Most Tax Friendly States For Retirees Ranked Goodlife

Iconic Idaho Idaho At Play Volume I Idaho Best Places To Retire Natural Landmarks