excise tax division nc

Notice on Relief to Excise Taxpayers Affected by Novel Coronavirus Disease 2019 COVID-19 - Effective March 31 2020. Legal Name Trade Name.

Excise Tax Technical Bulletins.

. Pick the document template you need from the collection of legal form samples. Motor Fuels and Alternative Fuels Tax Rate from July 1 2014 through December 31 2014. Kerosene Used in Aviation - Form 720 Tax Liability Reporting Kerosene is generally taxed at 0244 per gallon unless a reduced rate applies.

Motor Fuels and Alternative Fuels Tax Rate January 1 2015 through June 30 2015 - Effective April 1 2015 Senate Bill 20 was passed changing the motor fuels tax rate. North carolina department of revenue excise tax division international fuel tax agreement compliance manual october 2011. The excise tax is deposited in the Black Lung Disability Trust Fund.

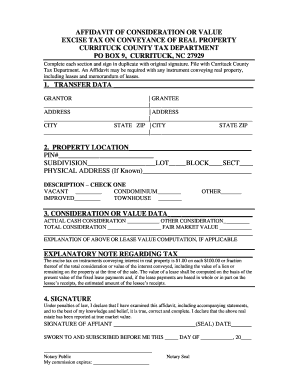

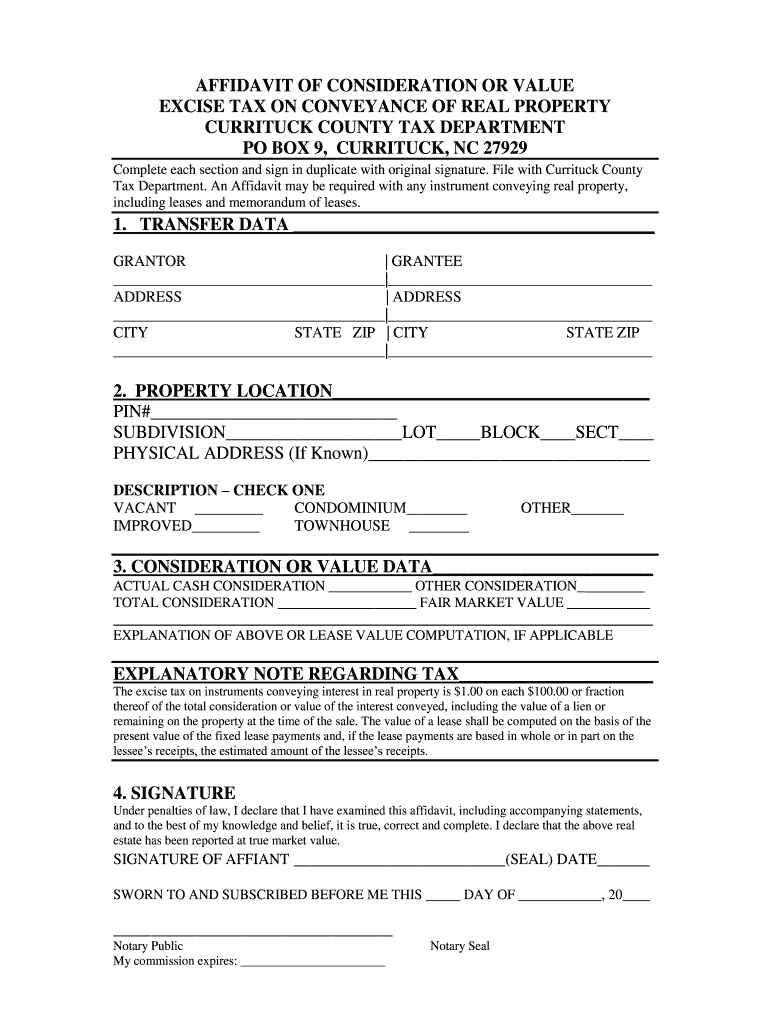

1 2020 Information Who Must Apply Cig License. The tax rate is one dollar 100 on each five hundred dollars 50000 or fractional part thereof of the consideration or value of the interest conveyed. PO Box 25000 Raleigh NC 27640-0640.

NCAC Title 17 - Revenue Chapter 04 - License and Excise Tax Division. Individual income tax refund inquiries. Imposition of excise tax.

Save Time Editing Signing Filling PDF Documents Online. Only complete this form if your contact information such as address email address or phone number has changed. How can we make this page better for you.

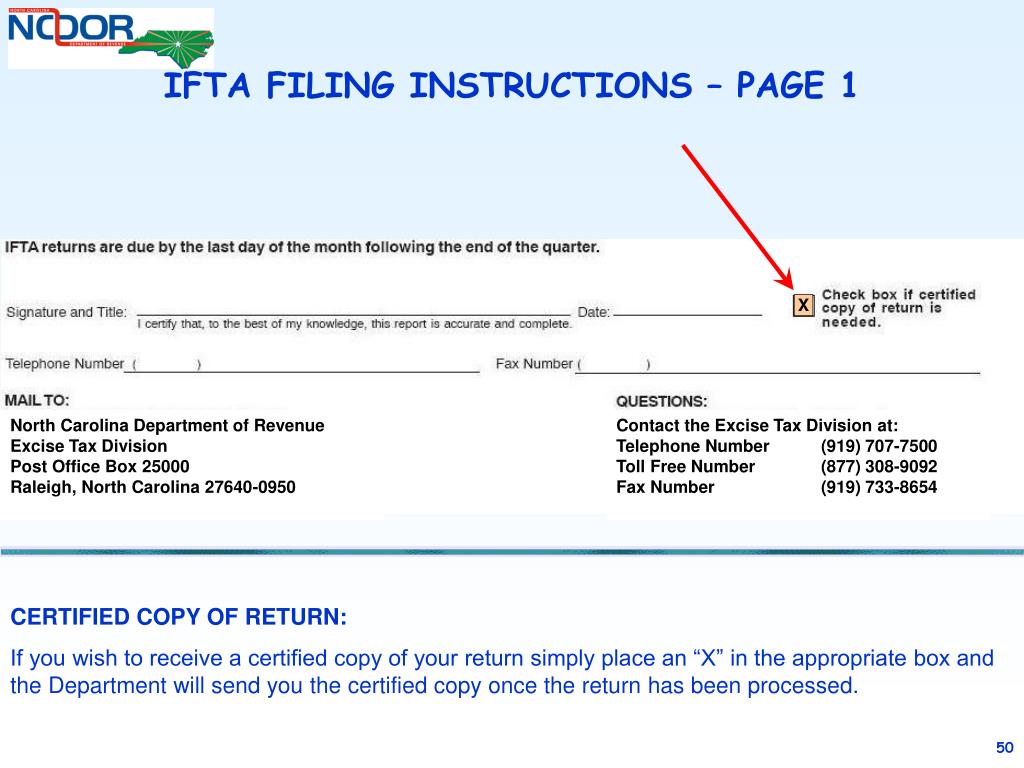

North Carolina Department of. If you have questions about the information in this notice please contact the Excise Tax Division at telephone number 919 707-7500 or toll free at 877 308-9092. 200 for payment amounts of 01 to 10000 400 for payment amounts of 10001 to 20000 600 for payment amounts of 20001 to 30000 How Do I Submit My Payment.

PO Box 25000 Raleigh NC 27640-0640. Join Now for Instant Benefits. We have placed a new secure outdoor drop box beside the mailboxes in the Judge E.

Fill in all the necessary boxes these are yellowish. The fee is 200 for every 100 increment. NORTH CAROLINA DEPARTMENT OF REVENUE EXCISE TAX DIVISION INTERNATIONAL FUEL TAX AGREEMENT COMPLIANCE MANUAL October 2012.

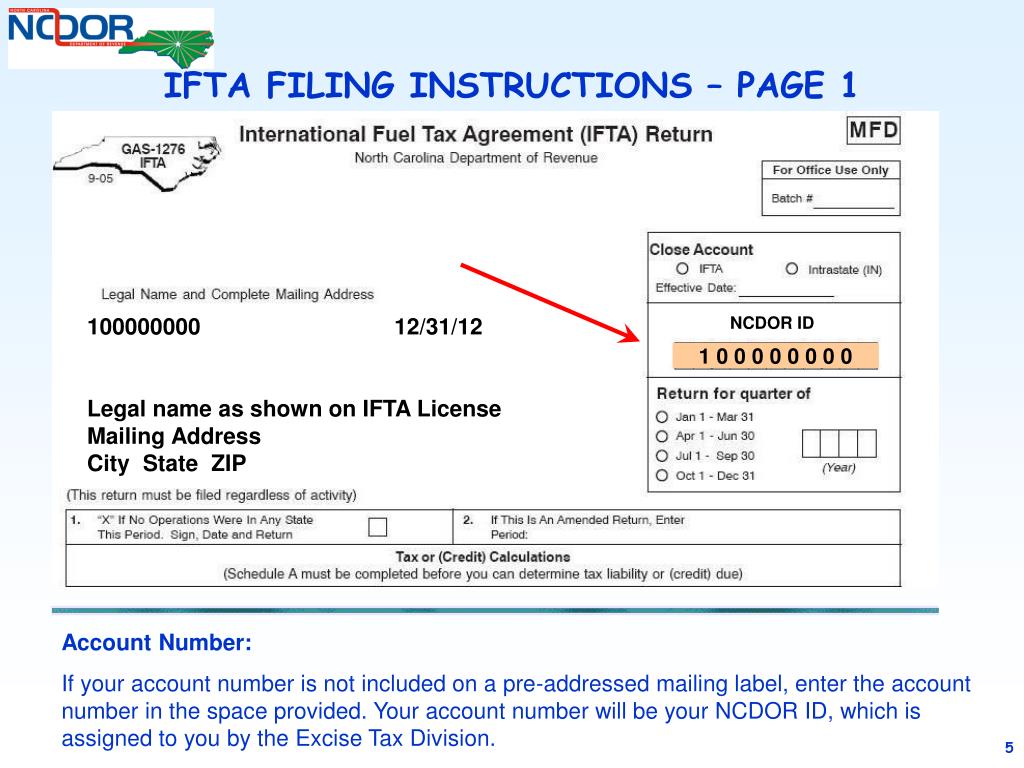

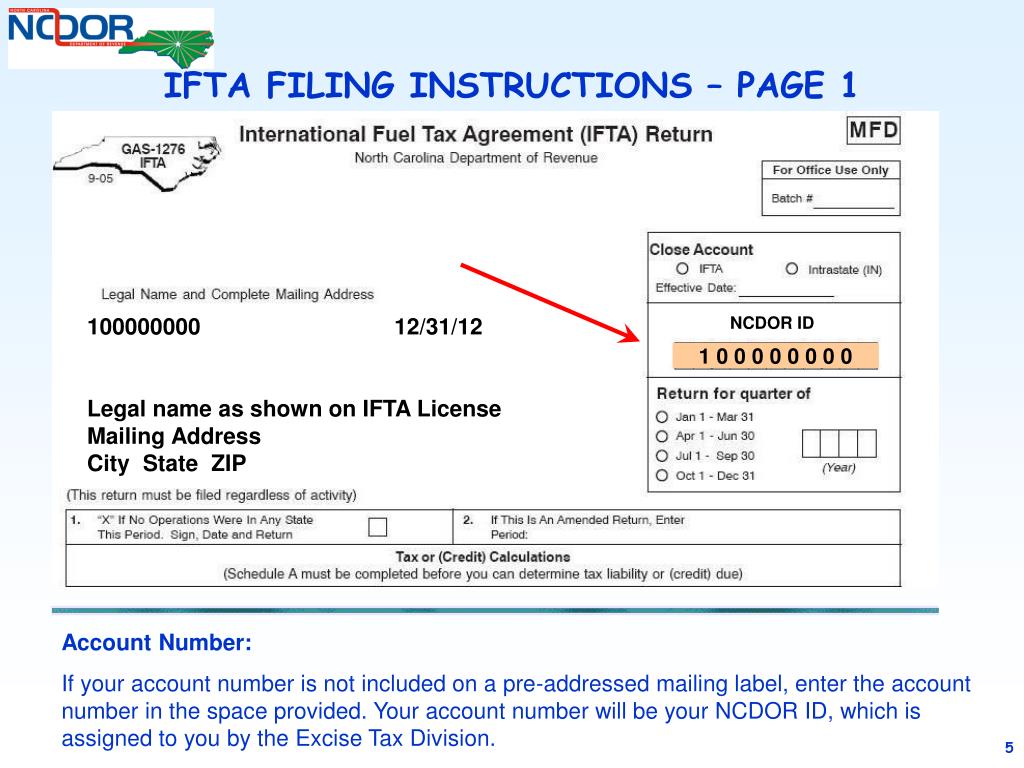

Excise Tax Division 1429 Rock Quarry Road Suite 105 Raleigh NC 27610 Telephone. See the following example. In order to participate in the program you must be registered with the Excise Tax Division as an IFTA or Intrastate Carrier and have an access code which has not expired.

When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday Sunday or Legal Holiday - April 12 2016. Execute Nc Department Of Revenue Excise Tax Division Form in just a few minutes by simply following the instructions listed below. The new office on Terminal Drive will open on Monday May 17 2021.

Appendix b - north carolina motor fuels tax temporary trip permits. Click on the Get form key to open it and start editing. 1-877-308-9092 2018 MOTOR CARRIER SEMINARS SPONSORED BY THE EXCISE TAX DIVISION REGISTRATION FORM No registration fee required In an effort to better serve you the North Carolina Department of Revenue is sponsoring a series of Motor.

See announcement covering April 1 2015 through December 31 2015. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. 17 NCAC 04A 0101-0108.

What is excise tax on real estate in NC. When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 or fraction thereof is levied on the value of the property ie. In an effort to ensure taxpayers contact information is valid and up to date the Department of Revenue Excise Tax Division is requesting that registered Excise Taxpayers submit their updated contact information.

This tax is typically paid by the seller. Maurice Braswell Cumberland County Courthouse back parking lot off Cool Spring and Russell Streets. North Carolina Department of Revenue.

A convenience fee is charged if you choose the DebitCredit Card payment option. 600 transfer tax on the sale of a 300000 home. North Carolina Department of Revenue Excise Tax Division 3301 Terminal Drive Suite 125 Raleigh North Carolina 27604 The move is scheduled for the week of May 10 2021 and the office on Rock Quarry Road will be closed from Monday May 10 through Friday May 14.

North Carolina Department of Revenue Post Office Box 25000 Raleigh North Carolina 27640-0001 wwwncdorgov. PRIOR WRITTEN NOTIFICATION REQUIRED FROM NC CUSTOMERS. Chapter 04 consolidated License and Excise Tax Division.

Individual income tax refund inquiries. HTML DOC. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

If you have questions regarding registration internet requirements or receipt and use of the access code please contact the Excise Tax Division. International fuel tax agreement compliance manual table of contents. Tax Administration has added another contactless option for making check or money order tax payments and for submitting tax listings and forms.

REAL ESTATE TRANSFER TAX. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. Ad Professional Document Creator and Editor.

There is no mortgage tax in North Carolina. INTERNATIONAL FUEL TAX AGREEMENT. 17 NCAC 04C 1704.

North Carolina Department of Revenue. Excise Tax is a state tax computed at the rate of 100 on each 50000 or fractional part thereof of the consideration or value of the interest conveyed payable by the seller at the time of recording. Excise Tax on Coal Internal Revenue Code 4121 imposes an excise tax on coal from mines located in the United States sold by the producer.

Form Gas-1274 by contacting the Excise Tax Division hereafter referenced as Division ofice located in Raleigh at 919 733-3409 or 877 308-9092 or.

Ppt Completing An Ifta Tax Return Powerpoint Presentation Free Download Id 527733

Affidavit Consideration Excise Tax Property Form Fill Out And Sign Printable Pdf Template Signnow

Nc Affidavit Of Consideration Or Value Excise Tax On Conveyance Of Real Property Fill And Sign Printable Template Online Us Legal Forms

Motor Carrier Registration Excise Tax Division 1 July Ppt Download

Ifta Newsletter 2011 March State Publications I North Carolina Digital Collections

Motor Carrier Registration Excise Tax Division 1 July Ppt Download

North Carolina Alcohol Taxes Liquor Wine And Beer Taxes For 2022

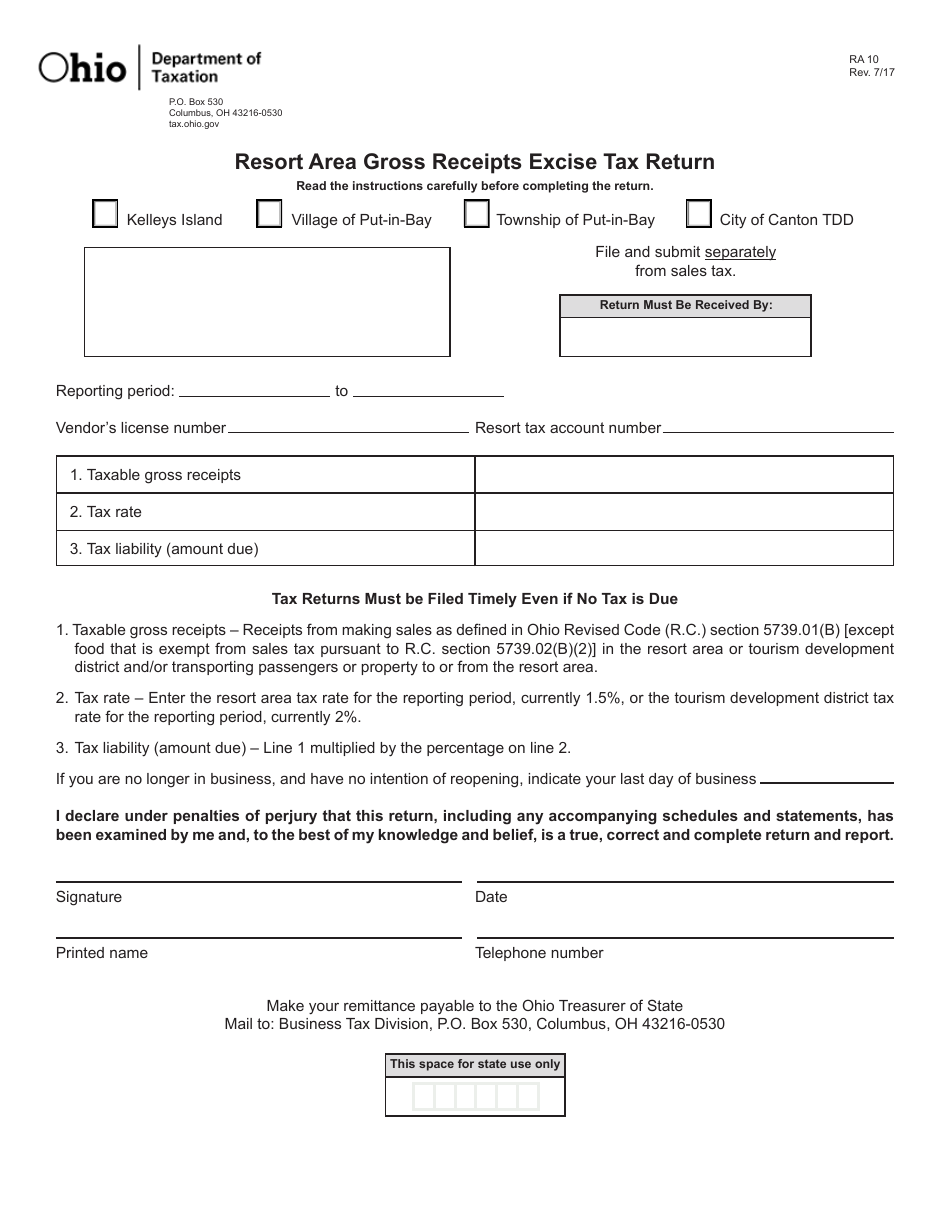

Form Ra 10 Download Fillable Pdf Or Fill Online Resort Area Gross Receipts Excise Tax Return Ohio Templateroller

John Panza Director Excise Tax Division Nc Department Of Revenue Linkedin

Ppt Completing An Ifta Tax Return Powerpoint Presentation Free Download Id 527733

Motor Carrier Registration Excise Tax Division 1 July Ppt Download